- Find Workers⌄

Every day, the Instawork platform handles thousands of transactions involving businesses and hourly professionals, generating a huge amount of data on hourly pay as well as other aspects of the labor market. This report summarizes some of the major trends in demographics, roles, and worker constraints in regions across the United States. For those looking for Temp Staffing and Workers in Vista | Instawork, this data is particularly relevant.

The data are also compiled into the Instawork Pay Signal Index (PSI) and indexed trends in hourly pay. Because businesses can book shifts in advance on the Instawork platform, the metrics include forward-looking data for the current month as well. Please refer to the appendix for explanations of the methods behind each metric.

In March, a preponderance of businesses raised hourly pay for flexible workers, despite lower offers heading into the month:

This month we are introducing a new section of the report based on data from surveys delivered via the Instawork Pro app. For details on methods and questionnaires, please see the Methodological Appendix below.

These surveys track Pros' labor market situations on a monthly basis. Here is the distribution of Pros by the hours they worked in 7 of the most common self-employment tax questions, answered.

These surveys track Pros' labor market situations on a monthly basis. Here is the distribution of Pros by the hours they worked in all jobs during the reference week (20 March 2023) versus the hours they would have preferred to work:

As we reported last week using earlier survey data, Pros want more hours. In fact, more than half of them said they wanted to work more than 40 hours per week, but only a third of them actually did. Here is a similar breakdown for the types of jobs they worked in the reference week:

Almost half of surveyed Pros said they had a full-time job, but many more wanted one. The numbers were very similar for part-time jobs. By contrast, the share of Pros looking to work Instawork shifts was only slightly larger than the share who said they would work shifts during the reference week. Very few Pros said they did not want to work at all.

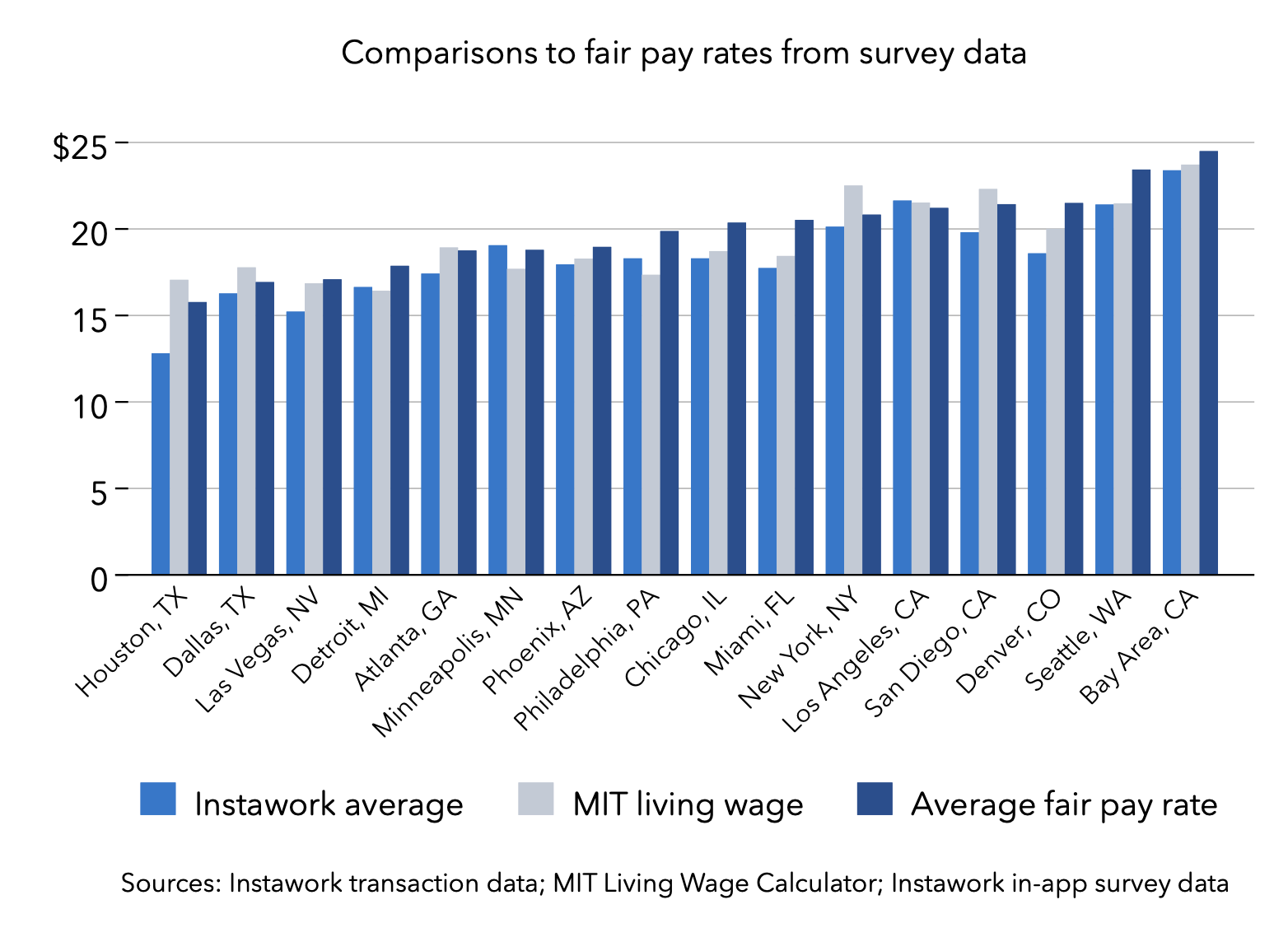

Each month the surveys will include an additional one-off question on a separate topic. This month, the question was, "What is a fair hourly rate for an easy shift close to your home?" Here are the responses for our selection of our biggest markets. The "fair pay rate" was averaged among the respondents in each market and compared with the average hourly rate earned by Pros in March and the MIT Living Wage for a single person with no children:

It is important to keep in mind that the Instawork average hourly rate in each market depends on the local mix of roles and industries. Generally, the average is close to the MIT Living Wage. But in many cases, Pros believe a fair pay rate would exceed both numbers. The gaps are particularly large in the Philadelphia, Chicago, Miami, and Seattle metro areas. By contrast, the average Instawork rate exceeds both the average fair pay rate and the MIT Living wage in Minneapolis and Los Angeles.

The share of men working shifts on the platform fell significantly for the first time since August 2022, while the share of white workers rose for the ninth month straight. The fact that white workers, who typically have lower unemployment rates than Black/African-American and Hispanic/Latino workers, are increasingly accessing flexible work suggests that the overall labor market is cooling.

Slightly more businesses raised pay than lowered pay in every occupational group we track during March. Pay offers bounced back in building and grounds cleaning, ticked up strongly in production, and continued a three-month streak of higher rates in transportation and material moving: